12/08/2019

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.97 | 1.09 | 9'749.92 | 3'333.74 | 11'693.80 | 5'327.92 | 7'253.85 | 2'918.65 | 7'959.14 | 20'684.82 | 981.19 |

| Trend | |||||||||||

| %YTD | -0.91% | -3.34% | 15.67% | 11.07% | 10.75% | 12.62% | 7.81% | 16.43% | 19.95% | 3.35% | 1.60% |

Highlights:

1. Bond yields plunge

2. Better-than-expected data out of China

Storm warning

Volatility in equity markets worsened last week in response to a string of disappointing economic stats, to the bombshell in Italy that has plunged the government into crisis and to remarks from Donald Trump, who says he would be perfectly okay if the negotiations planned with China in September were cancelled.

Equities also reacted negatively to the sudden plunge in bond yields. The return earned on 10-year Treasuries sank to 1.7%, the same maturity on Swiss government bonds is nudging -1% while the 10-year bonds of 15 European countries have joined the negative-yield club. Fears of a global recession are also encouraging investors into safe havens such as the Swiss franc, the yen or gold.

Three central banks cut policy rates last week. But the buffer effects of looser monetary policies may not be enough – a viewpoint which is now stoking volatility in financial markets. The hazy conditions are boosting demand for the US dollar by generating a massive rally on bonds. Foreign ownership of US government bonds is up 6% since last year. Dollar appreciation against several other currencies is blunting the competitive edge of US multinationals.

In Italy, the governing coalition is now under threat after vice-PM and interior minister Matteo Salvini, from the right-wing League, on Thursday called for a vote of confidence in his own government so that ‘the people could be given a say’. He hopes that this move will trigger early elections this autumn. Serious doubts about the country’s economic outlook and budget deficit sent yields rising on 10-year BTPs (Italian government bonds) to 1.8% and also led European banking stocks substantially lower.

On the macroeconomic front, better data out of China than expected soothed investor nerves, as did the People’s Bank of China when it set the pivot slightly above 7 yuan to the dollar: a well-judged remedy but nothing too radical. Chinese exports in July rose by 3.3% year on year. But in spite of the import duties, the trade deficit in relation to the US swelled to USD 68.5bn over the first seven months of the year. In Germany, exports fell and factory output continued to contract.

Summing up, global trade is stagnating, German industry is in a recession but business remains relatively robust in China, and services are showing resilience on the whole. Despite the disruptions, this consideration can still support equity markets.

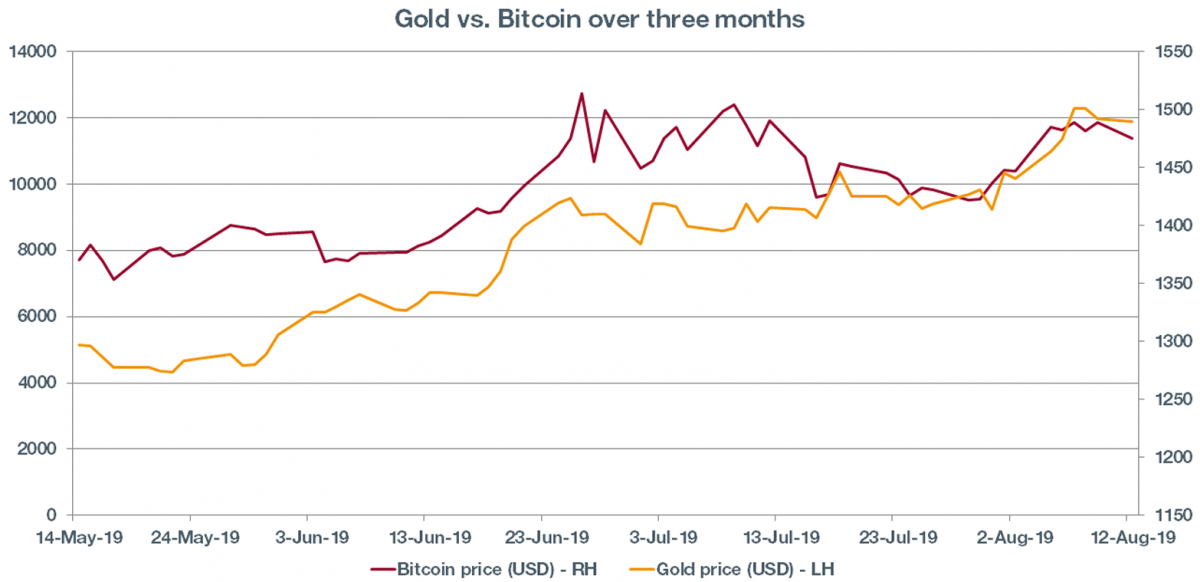

Recent correlation between gold and Bitcoin

Gold and Bitcoin are two assets that do not seem to have anything in common at first glance. Gold is a rare metal that can be held for investment purposes but which is also a raw material. It can be used for making jewellery, for example. Gold is tangible. Bitcoin is a paperless currency which only exists in the form of computer code. But both have seen an uptick in performance over the past three months – especially in August.

We think this correlation is misleading and will not last. It is certainly dangerous to consider Bitcoin as a safe haven. As a reminder, the cryptocurrency shed three-quarters of its value in 2018. Yet we have drawn some parallels from recent events that might account for the common fate of these two assets.

Currency war

One of Bitcoin’s specific features is that it is unconnected with a central issuing bank and so cannot be deliberately devalued. Neither can gold. Economist Robert Mundell said in 2011: “Gold is nobody’s liability and it can’t be printed”. So we have two assets which are inoculated against the currency wars waged at the moment by two leading global economies, China and the US. Devaluing a currency – often used to kick-start a national economy – has no impact for those holding gold or Bitcoin.

Interest rates

Neither Bitcoin nor gold pay their holders in the form of interest, unlike a bond, which pays a coupon. Right now, 15 trillion dollars of debt is exhibiting a negative yield. The opportunity cost for holding gold or Bitcoin has never been so low.

Volatility

The mood of doubt fostered by the US-China trade war is prompting investors to ditch risk assets in favour of safe havens: gold as well as the Swiss franc and the yen. The varyingly erratic moves on Bitcoin reduce its correlation to risk assets to almost zero, thus making it more attractive to investors in times of turbulence.

Download the Flash boursier (pdf)

Flash boursier

Flash boursier