17/05/2021

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.90 | 1.09 | 11'120.77 | 4'017.44 | 15'416.64 | 6'385.14 | 7'043.61 | 4'173.85 | 13'429.98 | 28'084.47 | 1'307.53 |

| Trend | |||||||||||

| YTD | 1.85% | 1.22% | 3.90% | 13.08% | 12.38% | 15.02% | 9.03% | 11.12% | 4.20% | 2.33% | 1.26% |

(values from the Friday preceding publication)

Inflation: to be, or not to be?

Inflation figures from the US called the tune in financial markets last week, after fears were stoked by booming commodity prices and supply bottlenecks for some types of goods. The price data clocked in well above expectations, springing a nasty surprise on equity investors.

This consumer price index jumped by 4.2% year-on-year in April. The less volatile core inflation was up by 3%. In contrast, stagnant US retail sales in April and a low capacity utilisation figure (74.9%) – showing that the economy is far from overheating – probably supported share prices towards the end of the week.

The inflation surge was largely powered by the base effect, in comparison with the depressed April 2020 level. Prices of air tickets and hotel stays have soared. However, rents and medical services, which are slower moving and more reflective of inflation expectations, have risen more moderately, which is reassuring. Inflation quickened by 2% both in Germany and in the Eurozone, in line with expectations.

The question is whether this price upswing will last or not. The whole dilemma is keeping investors on their toes. Yet there is no clear answer. Some of the effects are likely to be temporary, linked to shortages; others will be longer lasting, as the huge US fiscal stimulus will boost aggregate demand.

Central banks, including both the ECB and the Fed, believe that the trend will not persist for more than a few months. Their main argument is that their economies are far from full employment. And some central banks are adamant about keeping monetary policy nice and loose. In the US, criticism of the Fed for once again ‘lagging behind the yield curve’ has been rife. Will this soon pave the way for ‘tapering’ (which means gradually reducing asset purchases followed by higher policy rates)?

The tech sector saw the fiercest correction last week. Growth stocks, which are hovering on high multiples, faced particularly harsh pressure due to rising long-term yields. However, tech majors with steady profits tended to be more resilient. In the long term, the sector will also be supported by the fiscal splurges.

Large buyback plans were announced by blue chips, which will support stock prices. Excess cash has resulted in a total in Europe that is 25% above pre-pandemic levels. In the US, the total is estimated close to USD 500bn – the loftiest level in 20 years and 35% higher than in 2020.

Alibaba: genuine blue chip

Alibaba, the world-famous Chinese merchant website, has unveiled results for its fiscal fourth quarter to March 2021. In the end, the group posted its first loss in a decade, reflecting to a one-off fine from Chinese authorities for allegedly abusing its dominant position by requiring merchants to use its platform exclusively.

This fine, totalling USD 2.8bn, represents 4% of the group’s revenues for the 2019 financial year. Without this fine, which came in lower than the market had estimated, profit would have risen by 41% over the period. The growth outlook for the current year is fixed at 30%, or even more.

The recent downswing in Alibaba’s share price stemmed partly from the government’s opposition to the late-2020 IPO of ANT, in which Alibaba holds a 33% stake. ANT operates the Alipay payment system as well as offering consumer loans and wealth management services. China wants to regain control of this business and is considering subjecting ANT to the same capital requirements as a Chinese bank, which would curtail its potential for expansion. At the moment, ANT is valued at around USD 150bn. Its latest profit increased by 50% year on year.

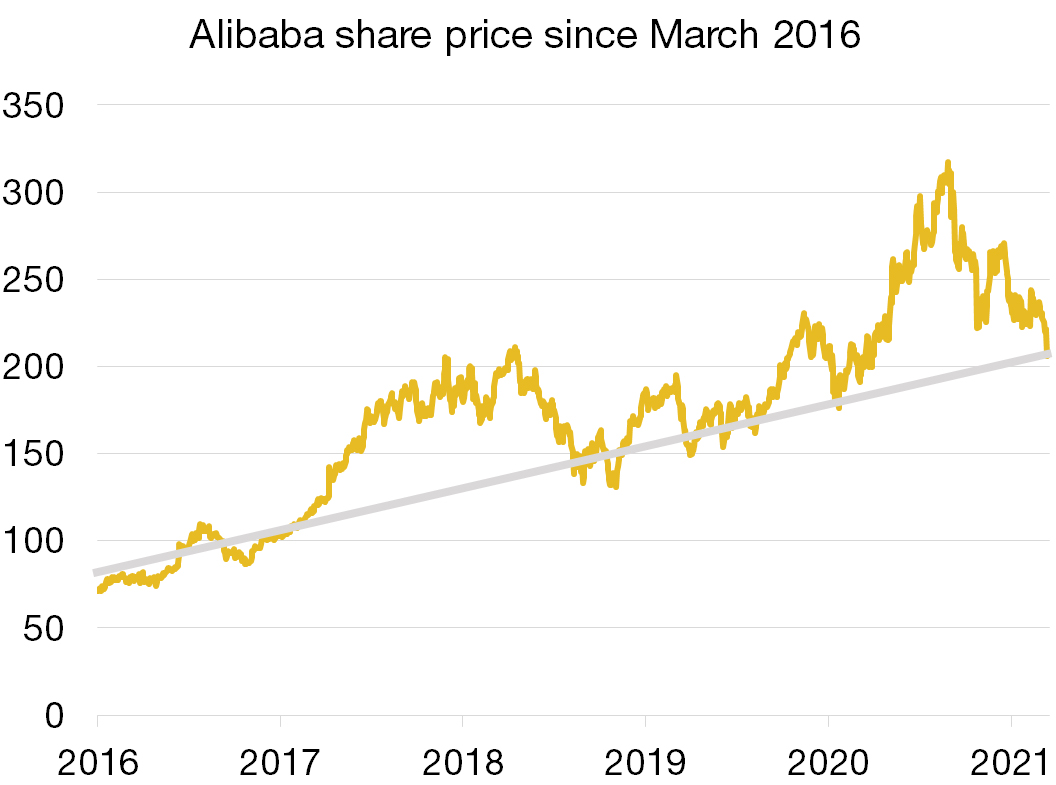

Alibaba’s stock looks extremely attractive at current levels (around 19x earnings), with growth of around 20% per year. Technically, the stock is trading close to its long-term support. Alibaba is a blue chip that has probably been hit too hard by investors.

Flash boursier

Flash boursier