05/07/2021

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.92 | 1.09 | 11'964.84 | 4'084.31 | 15'650.09 | 6'552.86 | 7'123.27 | 4'352.34 | 14'639.33 | 28'783.28 | 1'355.38 |

| Trend | |||||||||||

| YTD | 4.05% | 1.01% | 11.78% | 14.97% | 14.08% | 18.04% | 10.26% | 15.87% | 13.59% | 4.88% | 4.97% |

(values from the Friday preceding publication)

Gravity, where are you?

According to NASA, one of the main dangers involved in space travel is the lack of gravity, which is precisely what seems to be affecting financial markets at the moment. Leading equity indices continue to soar to new highs while bonds seem impervious to inflation fears, with long-term yields tumbling from their March peak. For an explanation, look no further than the ultra-loose monetary policies and splurges of fiscal stimulus. Yet the pace of growth could slow in the second half of the year as economies lose the impetus from the easing of lockdown measures and the dollars distributed to US households dry up. But does that mean that stock valuations will come back down to earth? Reported results and especially guidance numbers will tell us more in due course.

US equities started July on a high note last week, with the S&P 500 putting on 1.7% on the back of strong gains from tech and pharma blue chips. In contrast, main European indices corrected moderately. US job creation was better than expected, clocking at 850,000 in June and soaring past the 706,000 estimated – a sign of how strong the economic recovery has been. A large proportion of the jobs were created in the services sector, in catering, hotels and retail. However, many Americans are reluctant to return to work, either for fear of the virus or because unemployment benefits have been so generous. Unfilled job openings are currently estimated to exceed 9 million, which is almost equal to the number of people registered out of work. In this respect, the Fed has been clever in shifting its focus from inflation, which has been gathering pace, to the pre-covid levels of employment, which are still miles away. Back in March, many analysts saw the ten-year yield at around 2%. Purchases by pension funds, unsettled by the lofty equity valuations, and foreigner investors looking for yield have compressed this to 1.43%.

The IMF has sharply raised its growth forecast for the US and now foresees 7% in 2021 (up from 4.6% projected last April) and 4.9% in 2022. But this depends on the current budget plans, the infrastructure spending plan, the family support plan and the tax reform all making it over the finish line. That may be easier said than done.

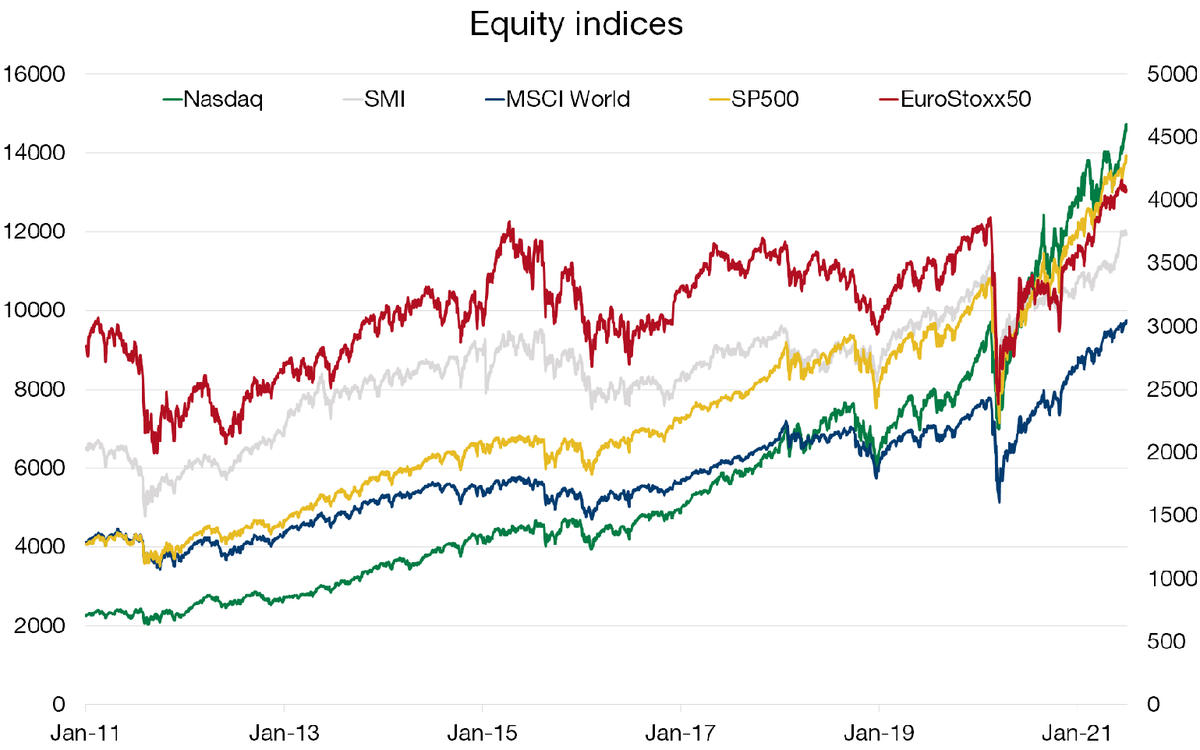

The relentless rise of equity indices

The rally by equity indices does not seem intent on halting any time soon. The macroeconomic recovery, accommodative central-bank policies and the lack of alternatives to equities – given the low yields and the tightest credit spreads in a decade – continue to support the upturn.

Similarly, the level of savings and the surge of capital into money market funds during the pandemic suggest that there is still a backlog of liquidity that still needs to be deployed.

Corporate earnings growth is another positive factor. Earnings expectations have snapped back to pre-pandemic levels, and nearly 50% of S&P 500 companies have raised their full-year guidance numbers in the last three months. However, much of the benefit of economic reopening has been priced in, and capital flows into more defensive sectors have recently been seen again, suggesting a slightly more cautious attitude among investors.

Cyclical stocks are set to continue gaining from rising consumer spending, but investors are also beginning to take a fresh look at secular growth stocks such as technology mega-caps.

Judging by the strong economic indicators in both the US and Europe and the piles of uninvested cash, the picture for equities is still too rosy for anyone to call an end to the bull market.

Flash boursier

Flash boursier