12/07/2021

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.91 | 1.09 | 11'989.81 | 4'068.09 | 15'687.93 | 6'529.42 | 7'121.88 | 4'369.55 | 14'701.92 | 27'940.42 | 1'318.17 |

| Trend | |||||||||||

| YTD | 3.28% | 0.37% | 12.02% | 14.51% | 14.35% | 17.62% | 10.24% | 16.33% | 14.07% | 1.81% | 2.08% |

(values from the Friday preceding publication)

Wind blows in new direction

Air currents have suddenly started blowing through markets, taking wind from the sails of the reflation trade to power ahead positions banking on a sharp slowdown in the global economy. This has been based on the assumption that the pace of growth has peaked as the effects of fiscal and monetary stimulus rapidly fizzle out. For proof, simply witness the buying frenzy surrounding US Treasury bonds, including the covering of short positions, which has depressed the 10-year yield below 1.3%. Published minutes from the latest Fed meeting, outlining the first steps to reduce securities purchases, at first fuelled fears of tapering until the Atlanta Fed president spoke out to calm investors, saying that this would be very gradual. The spread of the Delta variant, with the prospect of others emerging, has furthermore rekindled the possibility of further restrictions being placed on economic activity.

Key indices were hit by marked correction last Thursday, with financial stocks taking a particularly hard bashing. They then recovered on Friday as the S&P 500 and Nasdaq soared to set new records, buoyed by the upswing in growth stocks and raising the question as to whether this marks a new move of sector rotation, as cyclicals and value stocks are dumped in favour of tech and defensives. In our view, these sudden gyrations are overdone and diversification remains the watchword.

Important for inflation expectations, the US consumer price index for June will be released tomorrow. The consensus is 4.9%. This week also marks the kick-off for reporting season for major banks JP Morgan Chase, Goldman Sachs, Citigroup and Bank of America. Expectations are lofty for the second quarter of 2021 after the soft patch in the same quarter last year. Let’s hope they don’t disappoint.

Speaking after the G20 summit, Christine Lagarde stoked renewed expectations regarding the content of the monetary stimulus to be revealed at the ECB meeting on 22 July. The current bond-buying scheme amounting to EUR 1.85 billion should is set to run until at least the end of March 2022. For providing continued support to the Eurozone economy, this will be followed by a transition to another form, details of which will be revealed later.

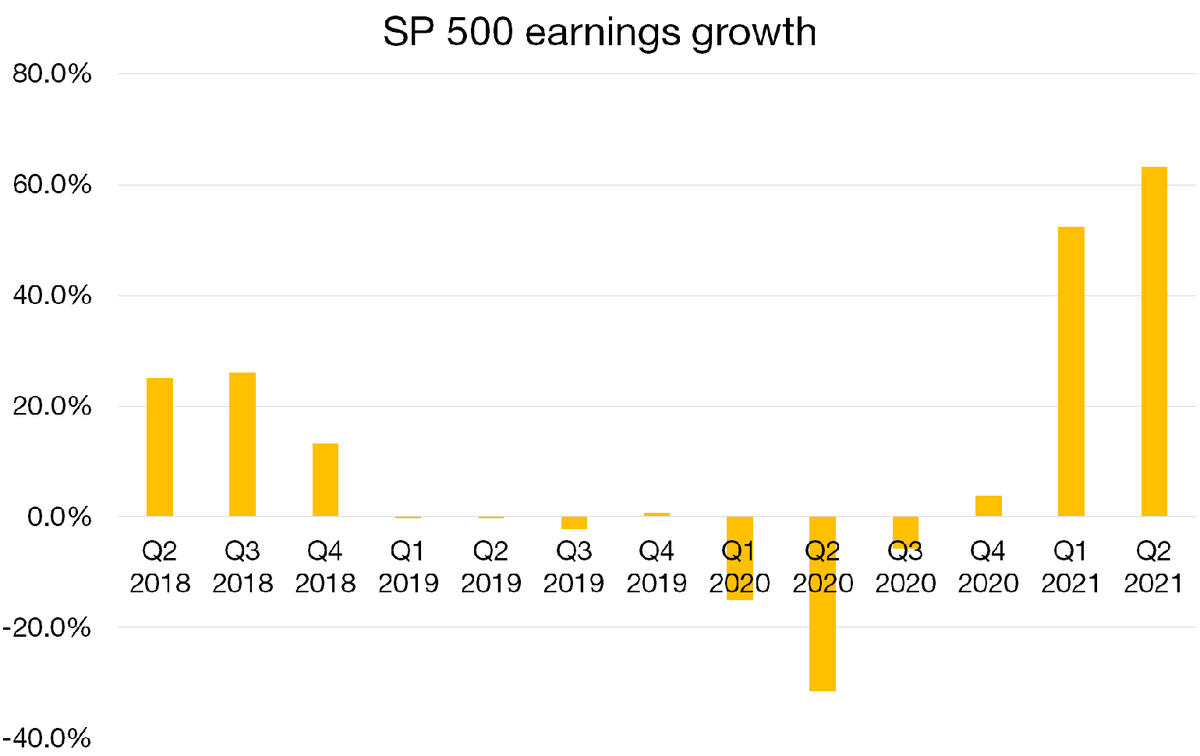

Record-breaking profit growth in sight

Reporting season starts this week and the pundits expect a sharp recovery in Q2 earnings relative to the year-earlier period, just as the S&P 500 is trading at record levels (having gained 16% YTD).

After earnings were depressed by the coronavirus pandemic last year, a surge exceeding 60% year-on-year is projected. Expectations for strong earnings growth have been one of the main reasons powering the rise in share prices this year and mean that even though the S&P 500 has reached an all-time high, key valuation metrics have remained broadly stable. The index is currently trading on 22.9x forward earnings, up from 22.2x at the end of December.

This earnings recovery is expected to be led by cyclical stocks – most notably financials and energy stocks, which have benefited from the recovery in US economic activity. According to the IMF, the American economy is growing at an estimated rate of 7%. Big banks like JPMorgan Chase, Bank of America and Citigroup are leading the way in what promises to be a record-breaking earnings season after posting a 52.5% average increase in the first quarter.

Flash boursier

Flash boursier