20/03/2023

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.93 | 0.99 | 10'613.55 | 4'064.99 | 14'768.20 | 6'925.40 | 7'335.40 | 3'916.64 | 11'630.51 | 27'333.79 | 951.56 |

| Trend | |||||||||||

| YTD | 0.21% | -0.18% | -1.08% | 7.15% | 6.07% | 6.98% | -1.56% | 2.01% | 11.12% | 4.75% | -0.50% |

(values from the Friday preceding publication)

Confidence plummets amid instability

Equity markets performed disparately last week following concerns over the shuttering of two US regional banks and the crisis of confidence hitting Credit Suisse. US indices benefited from a recovery in tech stocks, but European counterparts were hit by their exposure to financials.

Bond yields eased, with the US 10-year yield back at 3.45% and the German equivalent at 2.10%.

US inflation continued to slow in February. The consumer price index (CPI) was up 0.4% month-on-month after rising by 0.5% in January. On a year-on-year basis, the index was up by 6%, marking its lowest level since September 2021, compared with 6.4% in January.

In another sign of slowing economic activity, the producer price index (PPI) in the US unexpectedly edged down by 0.1% in February after a 0.3% uptick in January, led lower by food prices and energy costs. On a 12-month basis, the increase was 4.6%, compared to 6% the previous month. All this points to some moderation in inflation.

Initial jobless claims fell in the week beginning 6 March fell by 20,000 to 192,000, down from 212,000 the previous week. In addition, the four-week moving average, which serves as a trend indicator for the labour market, dipped by 750 relative to the prior week to 196,500.

In Europe, inflation is not going way. The CPI rose by 5.5% year-on-year in February, in line with forecasts. In France, the index rose by 1.1% in February, taking the year-on-year increase to 7.3%, which was slightly higher than the expected 7.2%.

In response to these conditions, the ECB raised its benchmark policy rate by a further 50 basis points and hinted at more to come, despite concerns about the health of the global financial system.

The S&P 500 ended the week up 1.43% while the tech-heavy Nasdaq gained from lower bond yields to advance firmly by 4.41%. The Stoxx 600 Europe, dragged down by the banking sector, fell by 3.85%.

With the SNB due to announce its decision on further monetary tightening this week, the financial sector is likely to remain a key focus for market participants in the near term.

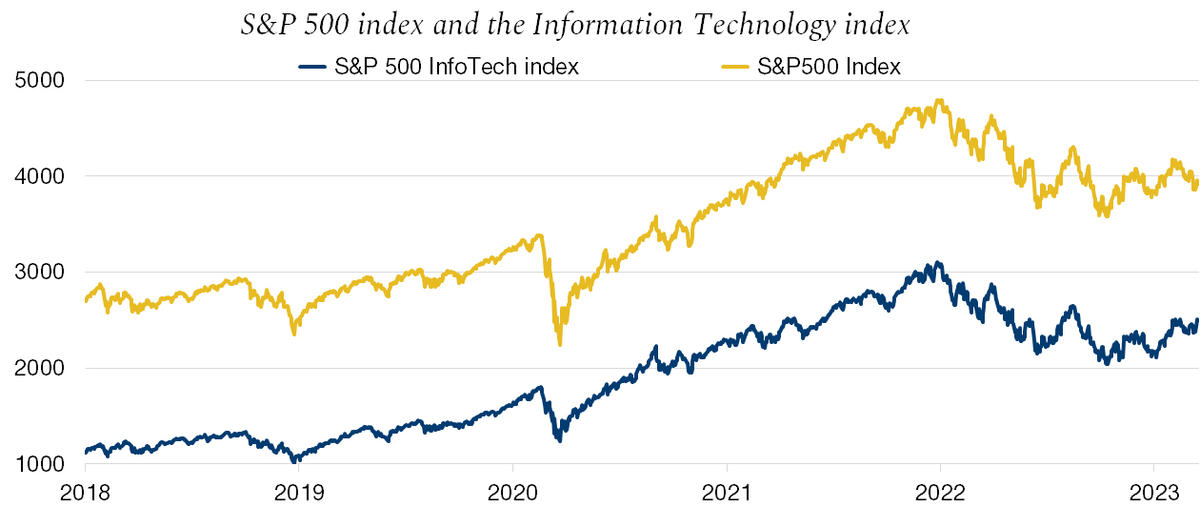

Rebalancing of US benchmark indices

The S&P 500 infotech index has been rebalanced, and this will have a direct impact on sector blue-chips such as Microsoft and Apple because of the stocks removed. In detail, payment companies Visa, Mastercard and PayPal are being transferred to the financials index.

The S&P 500 infotech grouping is thus purged of a few tech stocks, and the giants will see their influence in the information technology index increase accordingly. Moreover, their increased influence will prompt managers of benchmark strategies to reallocate funds to positions in these two stocks to keep their tracking error intact. Over-representation of these two industry giants in the infotech index will make the risk of underperformance increasingly difficult to manage as it will become impossible for the tech sector to outperform the broad market if Microsoft and Apple are not resilient.

Even with this rebalancing, tech will remain by far the largest of the 11 S&P 500 sectors, with a weighting of 30%. More impressively, it is twice as large as the second-largest sector, healthcare, which accounts for 15% of the benchmark.

Flash boursier

Flash boursier