Analyse February 2022

The future belongs to sustainable assets

Video production: Le Temps

COP 26, held in Scotland last November, did not produce any real solutions to existing problems. Climate events continue worsening. Yet the price of inaction far outweighs the cost of making changes to save the planet. One such change is investing in sustainable assets.

Negotiators from the 200 or so countries that met in Glasgow last November left with a so-called grand bargain in their suitcases. But decisive action to combat climate change proved to be out of reach. Instead, the participants had to bow to the demands of those who felt they had too much to lose in ratcheting up plans to phase out the use of coal and fossil fuels. Sadly the cost of inaction is higher – an argument lost on many of those in attendance.

Almost 200 billion per year

If you want to know if there’s a climate emergency going on, just ask the inhabitants of western and southern Germany. Last July, heavy rain triggered severe flooding and landslides, devastating villages and leading to the loss of some 100 lives. That example is foremost in our minds, because it happened not so long ago and because Germany is our neighbour. Yet over the last 20 years, 6,600 natural disasters have been recorded worldwide. Between 1980 and 2000, the number of was ‘mere’ 3,600. Compare that with only 1,200 catastrophes recorded between 1960 and 1979. The evidence is clear: floods, storms, hurricanes and heat waves are becoming irreparably more frequent.

And those natural disasters come at a price. Swiss Re, a specialist in this field, has the most accurate calculations, understandably because as a reinsurer, i.e. a company underwriting risks taken on by primary insurers, it receives the bills. Each year it publishes a natural catastrophes report. In 2020, the report showed that these events generated some USD 190 billion in economic losses, only half of which were insured. To this total we must add a phenomenon for which calculations are lacking: the direct, indirect and long-term effects of droughts.

The cost of stranded assets

At this rate, the EU – especially its southern and eastern rim – stands to lose EUR 65 billion a year by the end of the century. Additionally, the proliferation of extreme weather is not the only financial consequence linked to climate change. As societies seek to transition more hurriedly to clean energy, those banks and non-financial companies that do not mend their ways will be left with stranded assets on their hands.

What is a stranded asset? For an illustration, think of fixed telephone lines. How much were they worth after the advent of mobile communications networks? All it takes is a technological breakthrough, a new piece of regulation or, in the case of the climate transition, a paradigm shift and eventually the value of an investment will fall to zero. How much will an oil well in Alaska or a coal-fired power plant in Poland be worth in 2030 and again in 2050? No one really knows, but it is estimated that the overall losses racked up on this category of asset could be as high as USD 10 trillion.

How to limit the damage

For those who want to shape up to avoiding shipping out, the formula for mitigating this hit is obvious. We need to limit the prospective damage. How do we get there? By investing in non-fossil, renewable, environmentally friendly assets. These will increase in value over time, and investors have cottoned on to this. According to Bloomberg, sustainable assets, i.e. those meeting specific ESG (environmental, social and governance) criteria, have attained a value of USD 35 trillion, up from USD 23 trillion in 2016. According to this calculation, one dollar in three managed by a financial institution worldwide has been invested in social and climate-related causes. Isn’t it now time to earmark the other two for this same purpose?

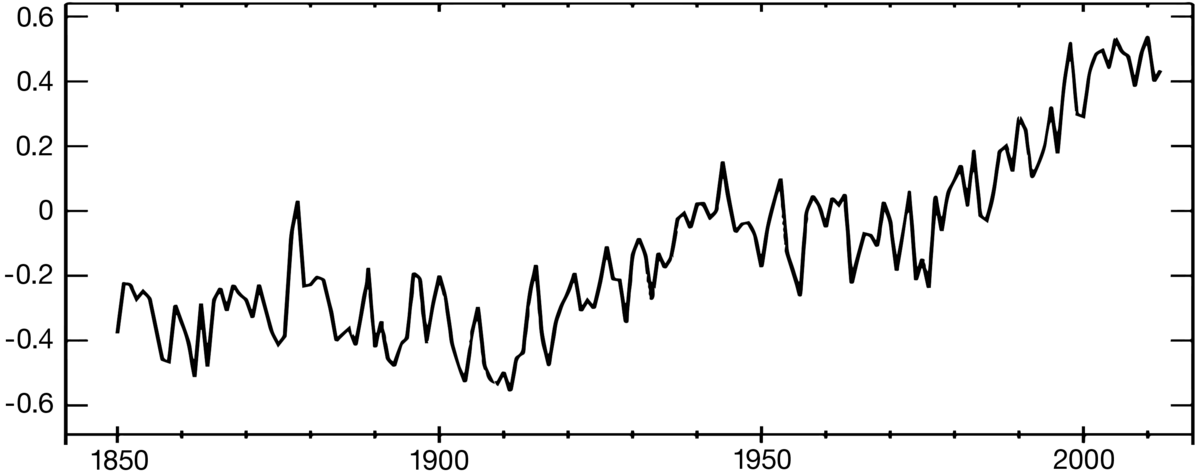

Fig. 1. Observed globally averaged combined land and ocean surface temperature anomaly 1850-2012 (Source: IPCC)

Latest news from the Bonhôte Group

Bonhôte awarded the global B Corp certification

Bonhôte Bank has been certified as a B Corp™ following a stringent assessment process that included a comprehensive review of its business activities, thereby recognising its long-standing dedication to CSR issues.

This award substantiates our strong social and environmental performance.

For more information, visit bonhote.ch/bcorp-label

New premises in the heart of Solothurn’s old town

Our Solothurn branch has moved into new offices ideally located in the heart of the old town.

Sascha Meier and his team look forward to hosting you at Gurzelngasse 22.

For more information, visit bonhote.ch/Solothurn-branch

15th anniversary of Bonhôte-Immobilier SICAV

The Bonhôte-Immobilier SICAV 15th anniversary gala evening was held this autumn at Microcity/EPFL Neuchâtel.

It was an immense pleasure to welcome the fund’s first-ever investors together with eco-explorer Raphaël Domjan.

For more information (in French), visit bonhote.ch/15e-BIM

Analyse

Analyse