11/05/2020

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.97 | 1.05 | 9'665.35 | 2'908.11 | 10'904.48 | 4'549.64 | 5'935.98 | 2'929.80 | 9'121.32 | 20'179.09 | 911.65 |

| Trend | |||||||||||

| %YTD | 0.49% | -3.06% | -8.96% | -22.35% | -17.70% | -23.89% | -21.30% | -9.32% | 1.66% | -14.70% | -18.21% |

Highlights:

1. US unemployment clocks in at 14.7%

2. China could unveil more monetary stimulus

Markets undaunted by record job attrition in the US

Risk assets continued recovering last week as investors disregarded lousy economic data, the mixed bag of first-quarter earnings releases and renewed bickering between China and the US. Companies also slashed guidance. The consensus now forecasts a 50% plunge in European corporate earnings for the second quarter. Last week the S&P 500 was up 3.5% and Nasdaq gained 6%. In Europe, stock markets were broadly unchanged, pinned back by widely divergent data and investors’ appraisals of the various national plans to ease lockdown restrictions.

In the US, the Bureau of Statistics released the worst employment report in a century, showing the unemployment rate soaring to 14.7%. A total of 20.5 million jobs were destroyed in April. To put this figure in perspective, companies shed a combined 17 million jobs during the last seven recessions. The latest surge in the jobless rate came despite the USD 700bn from the Paycheck Protection Program, aimed at keeping employees on the payroll. Reassuringly, for the vast majority of the newly unemployed (78%), their status is likely to be temporary.

Concurrent with the pandemic, the weightings of big tech in the S&P 500 – which had already been increasing during the pre-coronavirus era – have risen further. Social distancing measures and smart working have produced a kind of ‘surviving of the fittest’ mentality as investors consign travel & leisure groups, airlines and oil refiners to the evolutionary dustbin.

At the week begins, confidence in ‘Phase 2’ of the China-US trade deal and expected further monetary stimulus from Chinese authorities are leading equity markets higher. Countries around the world are proposing their own plans for easing lockdowns. Meanwhile European vehicle sales seem to be stabilising after dipping by only 5.5% in April. The Eurozone agreement reached on Friday offering loans at preferential rates for member countries to finance their fight against the coronavirus is also having a positive effect.

Regarding monetary policy, the People’s Bank of China has said it wants to use tougher stimulus policies to counter the dampening effect of the pandemic on economic growth. This coming Wednesday Fed Chairman Jerome Powell’s speech on the state of the economy will be watched closely to see if he moots the possibility of negative rates – an option that the Fed has so far rejected but which the market seems to favour, given the route that yields are currently taking.

Roche or Novartis?

The pharma sector has outperformed the broad market by more than 12% year to date, boosted by speculation over who will win the race to develop a Covid-19 vaccine and a reliable diagnostic test.

Investors are probably buying hot air, though, as many unknowns still exist. Will the potential vaccine arrive in time or only after the desired ‘herd immunity’ has been achieved? Will the virus have mutated or perhaps more or less vanished from the scene by the time the drug becomes available? Will production capacity be sufficient in the timeframe? These and so many other questions make predicting the potential revenue streams a haphazard exercise.

Most likely the final amount will represent only a fraction of the revenues reported by the largest groups in the running. The main unknown remains the number of companies that can bring a product to market. Provided this can actually be achieved, there will undoubtedly be more than one winner. China, the US and Europe have all entered the race, betting on more than 120 projects in total – at least 10 of which have already entered clinical trials.

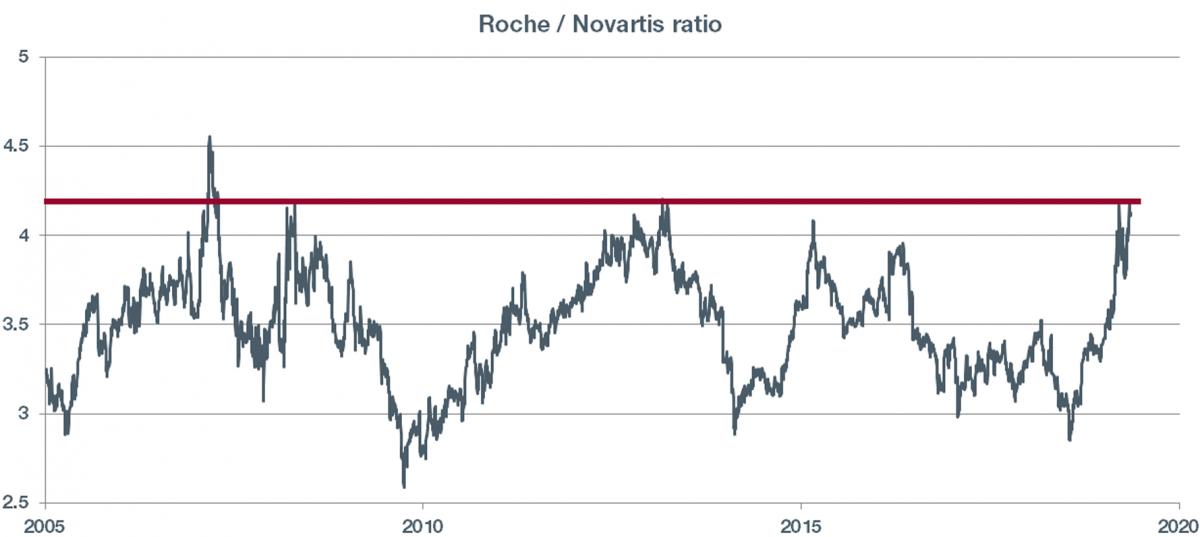

All this speculation has hoisted the Roche/Novartis ratio to an attractive level for rotating into Novartis. The P/E differential has narrowed to 2 points (15.5x for Roche versus 13.5x for Novartis).

Roche may be participating in the diagnostics race. However, Novartis is still buying back shares, with the aim to repurchase approximately 10% of the equity, and this is providing strong support for its share price. On current multiples, we advise picking Novartis ahead of Roche.

Flash boursier

Flash boursier