06/07/2020

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.95 | 1.06 | 10'125.84 | 3'294.38 | 12'528.18 | 5'007.14 | 5'935.98 | 3'130.01 | 10'207.63 | 22'306.48 | 1'033.09 |

| Trend | |||||||||||

| %YTD | -2.25% | -2.08% | -4.63% | -12.04% | -5.44% | -16.24% | -21.30% | -3.12% | 13.76% | -5.71% | -7.32% |

Highlights:

1. Asian benchmarks are up sharply

2. US jobs data beat expectations

Barrelling ahead

Stock markets leapt forward at the opening this morning, riding the momentum seen last week when the main benchmarks already racked up solid gains. Asian indices were up sharply, with Japan’s large exporters led by the auto and technology sectors, in particular, benefiting from the yen’s slight depreciation against the dollar.

On balance, however, data concerning the spread of Covid-19 seem alarming, with many countries experiencing high numbers of new infections, especially the US but also India and Brazil. New restrictive measures have been introduced in several regions, although widespread business shutdowns like those in March and April are quite unlikely. As a consequence, it looks as though consumer spending will not be affected much. Investors are focusing more on other factors. In particular, hopes of a quick economic recovery are gaining ground again in view of recent macro data. The development of vaccines is moreover progressing rapidly, fuelling optimism and whetting appetites for risk assets.

In bond markets, spreads continue to narrow. The yield on Italian 10-year government issues fell to 1.22%. Debt markets have been bolstered greatly by the flood of liquidity that the main central banks have injected into the financial system to avert a panic.

The minutes of the Fed’s June meeting show that the US central bank’s governors discussed the next steps to be taken, indicating that they are not ready to end their supportive measures.

In economic news, America’s employment figures were much better than expected, with a jump of 4.8 million new jobs created in June despite the spread of Covid-19 infections. The national jobless rate eased to 11%. In Europe the downturn in service industries abated. Factory orders in Germany rose 10% month on month in May. This is encouraging, even though the total is still down nearly 30% year on year. China’s services PMI stood at 58.4 at end-June, a historic high.

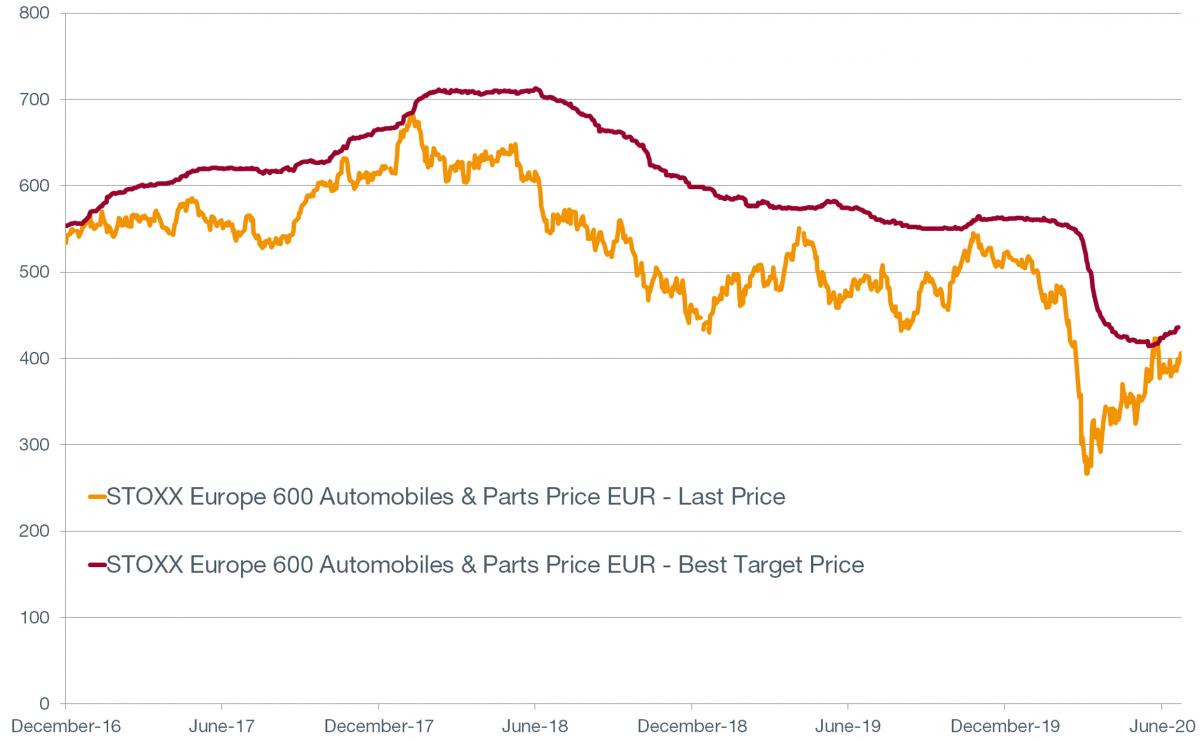

STOXX 600 AUTOMOBILES AND PARTS

The Coronavirus pandemic has seriously affected the global auto industry. Vehicle and parts manufactures are still not working at full capacity. As a result, the market could be further impacted by delayed shipments for a number of reasons including the financial difficulties faced by suppliers and assembly-line disruptions. All this comes atop numerous pre-existing challenges in the automobile sector such as compliance with CO2 emissions standards and the massive investments needed to develop electric cars.

With economies reopening, demand for vehicles is starting to bounce back, mainly in China, the US and France. Moreover, fears of contracting the Coronavirus on trains and buses are likely to spur additional sales.

The Stoxx Europe 600 Automobiles and Parts index has already roared back 50% since bottoming out in March. A positive signal can be seen in analysts’ stock price targets, which are turning back up after being revised downwards for months. On average, these shares are trading at a large discount, at 0.71 times their historical book value. Based on earnings forecasts for 2021, the sector’s P/E ratio of 10.7x is attractive. These rather depressed valuation multiples provide scope for a recovery.

Flash boursier

Flash boursier