24/01/2022

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.91 | 1.03 | 12'355.54 | 4'229.56 | 15'603.88 | 7'068.59 | 7'494.13 | 4'397.94 | 13'768.92 | 27'522.26 | 1'244.31 |

| Trend | |||||||||||

| YTD | -0.02% | -0.27% | -4.04% | -1.60% | -1.77% | -1.18% | 1.48% | -7.73% | -11.99% | -4.41% | 1.00% |

(values from the Friday preceding publication)

Turbulent start to the year

After making thundering gains in 2021, equity markets have started 2022 on a different footing. Without any particular news acting as a trigger, the overbuying of certain sectoral and thematic positions observed for more than two years is now correcting itself.

Since 2009, the Fed has supported the markets through monetary policy and a raft of quantitative easing plans. These continuous injections of liquidity have benefited equity markets by supplying a constant source of inflows. Investors had taken on board the fact that the Fed – through its asset purchases – would keep rates low and indirectly provide unconditional support to stocks. This even got a name: “the Fed put”. In recent years, moderate growth stocks with less sexy profiles have massively underperformed many companies offering exposure to more dynamic themes. This trend remained intact regardless of the fact that the companies neglected had strong balance sheets, steady earnings and often attractive valuations. Funds flowed indiscriminately into thematic index products such as ETFs (exchange traded funds), which buy a list of stocks representative of a theme without much in the way of bottom-up analysis. In this latest bull market, guided by a mood of exuberance, a historically high number of stocks that had never made a profit saw their share prices soar.

But the Fed does seem to have withdrawn its ‘put’. We have therefore been witnessing investors getting ‘back to basics’ since the beginning of the year. Strong stocks with low valuations are outperforming their pricey peers. Valuation differentials are narrowing back to standard readings.

This week investors are with some trepidation awaiting news of the Fed’s decision this coming Wednesday. This is expected to offer an indication of how quickly US rates will rise in 2022.

The geopolitical tensions surrounding Ukraine and high oil prices are also weighing on the overall mood amid the more inflationary conditions. In this setting, volatility has risen into the 30% range. Gold is recovering but still not very quickly, while cryptocurrencies have taken a hit. The price of Bitcoin is down by more than 27% since the beginning of the year. So conditions are more turbulent but the focus is firmly back on value and fundamentals. Investors can therefore expect some good opportunities, which may take the form either of premium income or, where called for, the construction of direct positions in blue-chip securities.

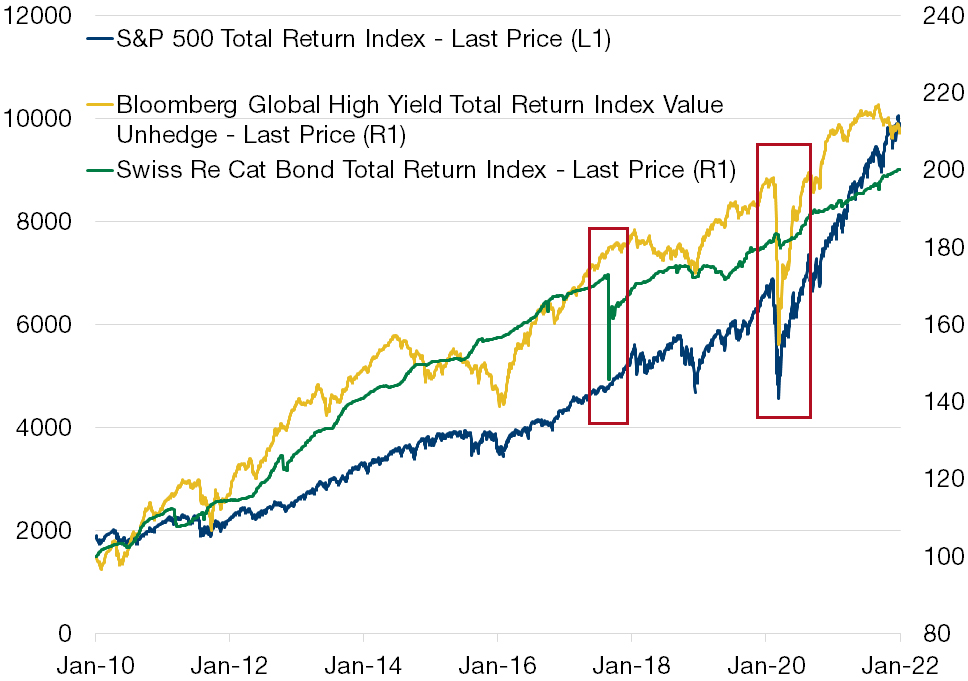

CAT bonds

CAT bonds are instruments that allow insurance companies to offload part of the risk linked to natural disasters to the market under specific terms, over a stated period of time. Coverage includes hurricanes and earthquakes, for example.

In return for this risk, investors receive a premium that varies according to the probability of loss occurrence. CAT bonds have four advantages:

- An average net return of 3.5% to 4%

- Virtually no taxation, as almost all the return stems from the insurance premium income

- No correlation with equity or bond market fluctuations, as the price of a CAT bond depends solely on the occurrence of the loss it covers

- No counterparty risk, as the investor’s money is only available to the issuer if the stipulated conditions are met

Investing in one CAT bond on its own can be very risky, but this kind of exposure makes sense when the investment is made through a diversified fund.

Flash boursier

Flash boursier