23/05/2022

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.97 | 1.03 | 11'308.98 | 3'657.03 | 13'981.91 | 6'285.24 | 7'389.98 | 3'901.36 | 11'354.62 | 26'739.03 | 1'035.31 |

| Trend | |||||||||||

| YTD | 6.86% | -0.76% | -12.17% | -14.92% | -11.98% | -12.13% | 0.07% | -18.14% | -27.42% | -7.13% | -15.97% |

(values from the Friday preceding publication)

Navigating the turbulent times

Last week was full of turmoil for markets – dominated by inflation, rate hikes and recessionary fears. The S&P 500 is dangerously testing a bear market threshold (-20% from highs), with investors wondering if it will stray beyond that point. Hurting share-price performance were earnings reports from US retail giants announcing a contraction in margins due to rising costs, reigniting fears that inflation will take a heavy toll on the economy.

Inflation is indeed starting to look ingrained in the US, making it the main concern for corporations. To date, a total of 445 S&P 500 constituents have released quarterly financial results; of these, 377 have mentioned ‘inflation’ in their messages. The mood of anxiety is increasingly reflected in earnings guidance, which has been revised down to 4.3% from 6% a month ago – far slower than the 8.3% increase in consumer prices. In contrast, revenue guidance remains upbeat. A 9.8% year-on-year increase is estimated for the next quarter.

This balancing act between growth, inflation and interest rates will be difficult to pull off, but Powell still believes that the US economy is capable of withstanding higher rates without tumbling into recession. The labour market is robust, whilst household spending and business investment remain strong. Growth for the US economy is estimated around 2.5%, which would keep the country in expansionary mode for another year.

In Europe, the latest inflation number was stable at 7.4%, but price rises are now seeping out beyond energy and food. This will probably prompt the ECB to start raising rates in July to offset the risk of an inflationary wage spiral. However, the ECB must be careful if it does not want to hamper economic growth, already burdened by the armed conflict in Ukraine.

China could be the boost the market is waiting for. Due to lockdowns, the Chinese economy is currently running in a low gear, and supply chains have been heavily disrupted, clouding the outlook for global growth. In contrast, the pandemic seems to be dying down, and the government is doing everything possible to ensure the domestic economy keeps expanding. Last Friday, Beijing cut the benchmark reference rate for the second time this year, pledging to take further supportive measures to combat the economic slowdown, giving markets the shot in the arm that they needed as the week tailed off.

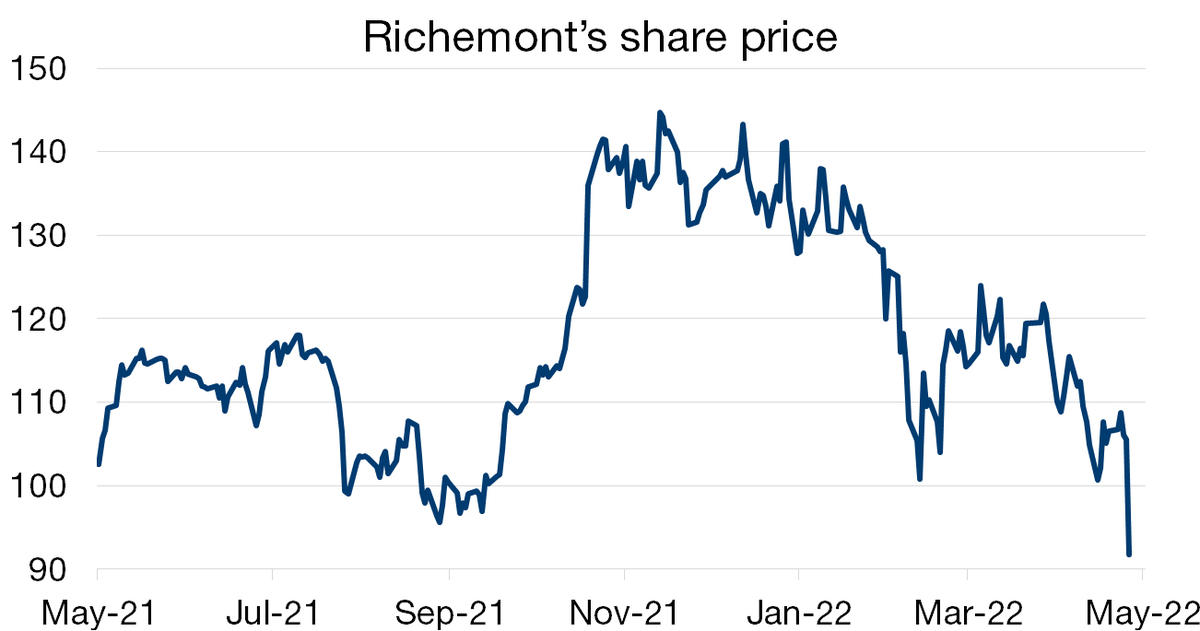

Richemont hit by sell-off

The group’s full-year results for 2020-21 were on average better than expected. Net profit increased by 61% to over EUR 2 billion on revenues surging by 44% to EUR 19.2 billion. Despite these solid figures, the share price tanked by 13% on Friday, dragged down by the gloomy outlook and the margin miss.

The jewellery and watch divisions – the group’s mainstays – powered the positive results, with revenues exceeding EUR 3 billion, meaning that the Geneva-based luxury group gained market share in these two business sectors. Jewellery brand Cartier generated record sales, which shot up by 49%. Sales at the group’s watch brands jumped by 53%.

The bad news was margins, hit by the suspension of business in Russia. This led to a charge of EUR 98 million and a writedown on inventories amounting to EUR 70 million. Rising costs and the lockdowns in China, which have forced the company to shutter 50 outlets in the country, were also to blame for this drop in profitability and will continue weighing on results in the future.

Despite softer margins, Richemont believes it has the flexibility to weather the current vagaries in the global economy and is solidly placed to benefit fully from a recovery in demand.

Flash boursier

Flash boursier