06/03/2023

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.94 | 1.00 | 11'190.09 | 4'294.80 | 15'578.39 | 7'348.12 | 7'947.11 | 4'045.64 | 11'689.01 | 27'927.47 | 988.03 |

| Trend | |||||||||||

| YTD | 1.25% | 0.56% | 4.29% | 13.21% | 11.88% | 13.51% | 6.65% | 5.37% | 11.68% | 7.02% | 3.31% |

(values from the Friday preceding publication)

Equity markets bounce back

Equity markets rallied last week, driven by solid economic data from China and accommodating remarks from Fed officials.

Bond yields rose slightly, with the US 10-year yield around 4% and the German equivalent close to 2.70%.

US manufacturing activity continued to lose traction in February. The ISM manufacturing PMI rose to 47.7 last month, up from 47.4 in January but below the forecast of 48. However, the ISM prices index rose to 51.3 from 44.5 in January, the highest reading since September. The services PMI slowed slightly in February to 55.1, down from 55.2 in January, although the figure beat forecasts (54.5).

The labour market remains healthy, as evidenced by the fact that initial jobless claims for the week ending 25 February came in at 190,000, below the forecast of 195,000.

Across Europe, inflation in France edged up to 7.2% year-on-year last month (from 7% in January) on the back of higher food and services prices. Month-on-month inflation was 1%, up from 0.4% in January. In Germany, inflation also accelerated to 9.3% in February, above the 9% forecast. These data prints increase the likelihood of further rate hikes by the ECB.

In China, service sector activity expanded at the fastest pace in six months in February as the lifting of pandemic measures in December boosted demand and led to employment growth. As a result, the Caixin services PMI came in at 55.0 last month, up from 52.9 in January.

In this mood, the S&P 500 ended the week up 1.90%, while the tech-heavy Nasdaq, which is more sensitive to interest rate expectations, rose 2.58%. The Stoxx 600 Europe was up 1.40%.

Volatility is likely to remain a factor in the coming weeks as the quarterly corporate earnings season draws to a close and the ECB and Fed decisions at the end of the month draw nearer.

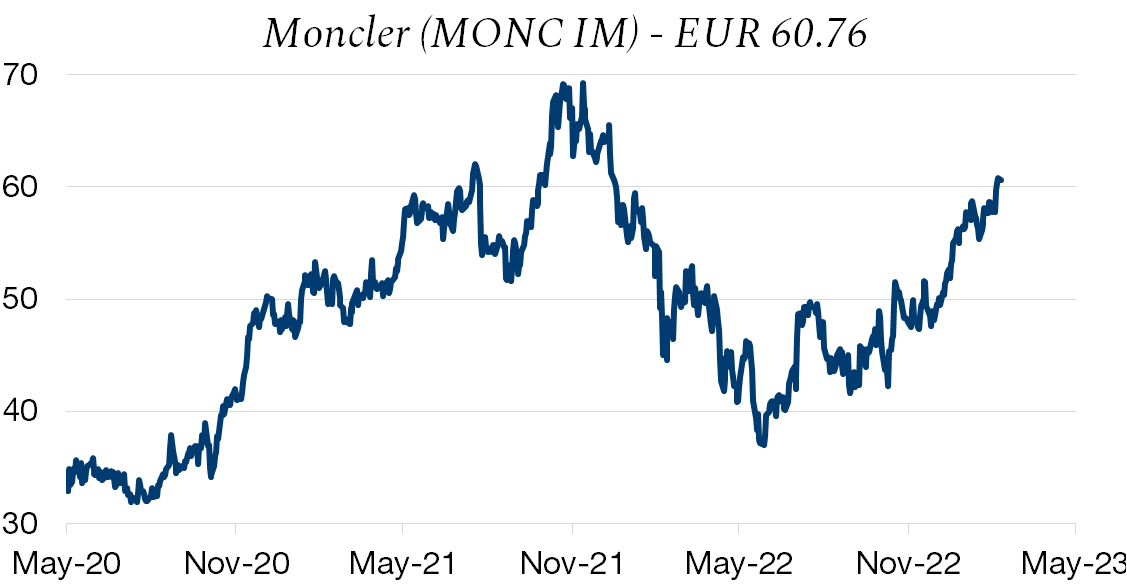

Moncler

The luxury goods group reported results that exceeded expectations. Sales totalled EUR 2.6 billion, representing 25% growth, with an operating margin of 28.9%, up 0.30 percentage points, and net profit up 47% to EUR 606.7 million.

Sales grew in all regions. Moncler brand sales were EUR 2.2 billion, representing double-digit growth (+29%), driven by the Eurozone, with strong local demand and tourist purchases. Asia also posted double-digit growth (+12%), driven by Hong Kong and Japan. In China, sales struggled to maintain the momentum from the beginning of the year and stagnated in Q4 as the zero-covid policy started to bite.

Apart from China, which ultimately outperformed its peers, sales growth in the US slowed in Q4 (+5%) due to a shift of purchases abroad and a strong base effect. The Stone Island brand contributed with sales of EUR 401 million, up 28% for the full year and 48% in Q4 alone. This brand posted double-digit growth in all regions, with Asia more than doubling after it began managing distribution in Korea and Japan itself.

According to management, 2023 is off to a solid start, with positive growth in all regions, including China. The group is capitalising on the brand’s popularity among young people and using this to charge higher prices. The earnings growth forecast for 2023 has been revised up to 6%.

The stock is currently trading 10% below 5-year average EVEBITDA and the sector average, but growth prospects are strong as the group continues to open new stores around the globe.

Flash boursier

Flash boursier